Go Spokane Real Estate

Welcome to Go Spokane Real Estate where you will find up to date information on the Spokane real estate market. Here you will find valuable resources whether you are looking to sell your home or buy a home in the Spokane area.

If you are looking at homes for sale in Spokane or the surrounding area, you can search the Spokane MLS. You can use your own custom search criteria or the home search map feature. I teach a home buyer education class in Spokane where you can learn more about the home buying process including home mortgage and many different home loan programs available.

If you own a Spokane home that you are considering selling, you will find information to help decide if now the right time to sell. Here you will see the latest statistics regarding the Spokane real estate market. There is also information that will help you price your home correctly and understand the importance of a good marketing plan.

Spokane Real Estate Market

April 2021

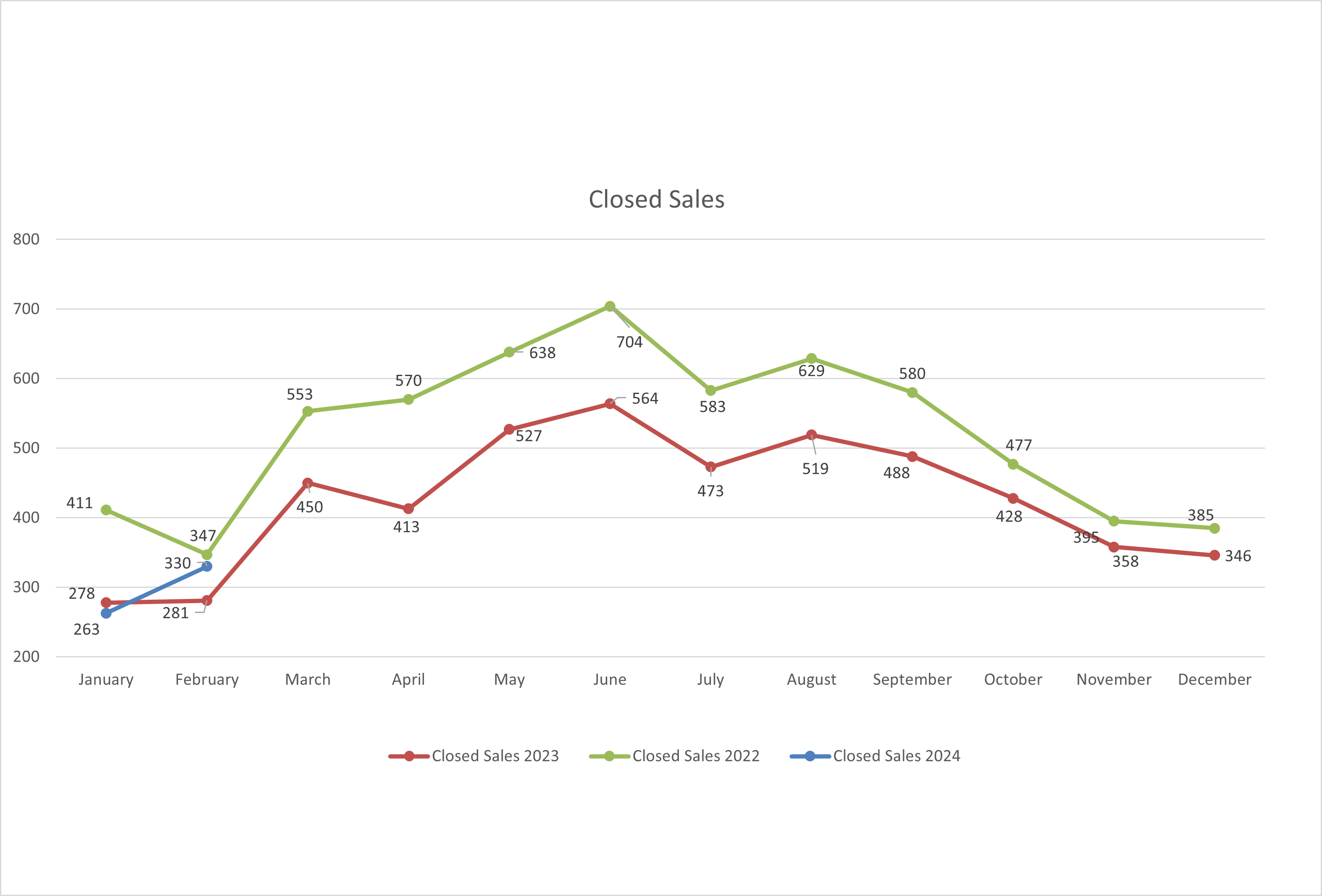

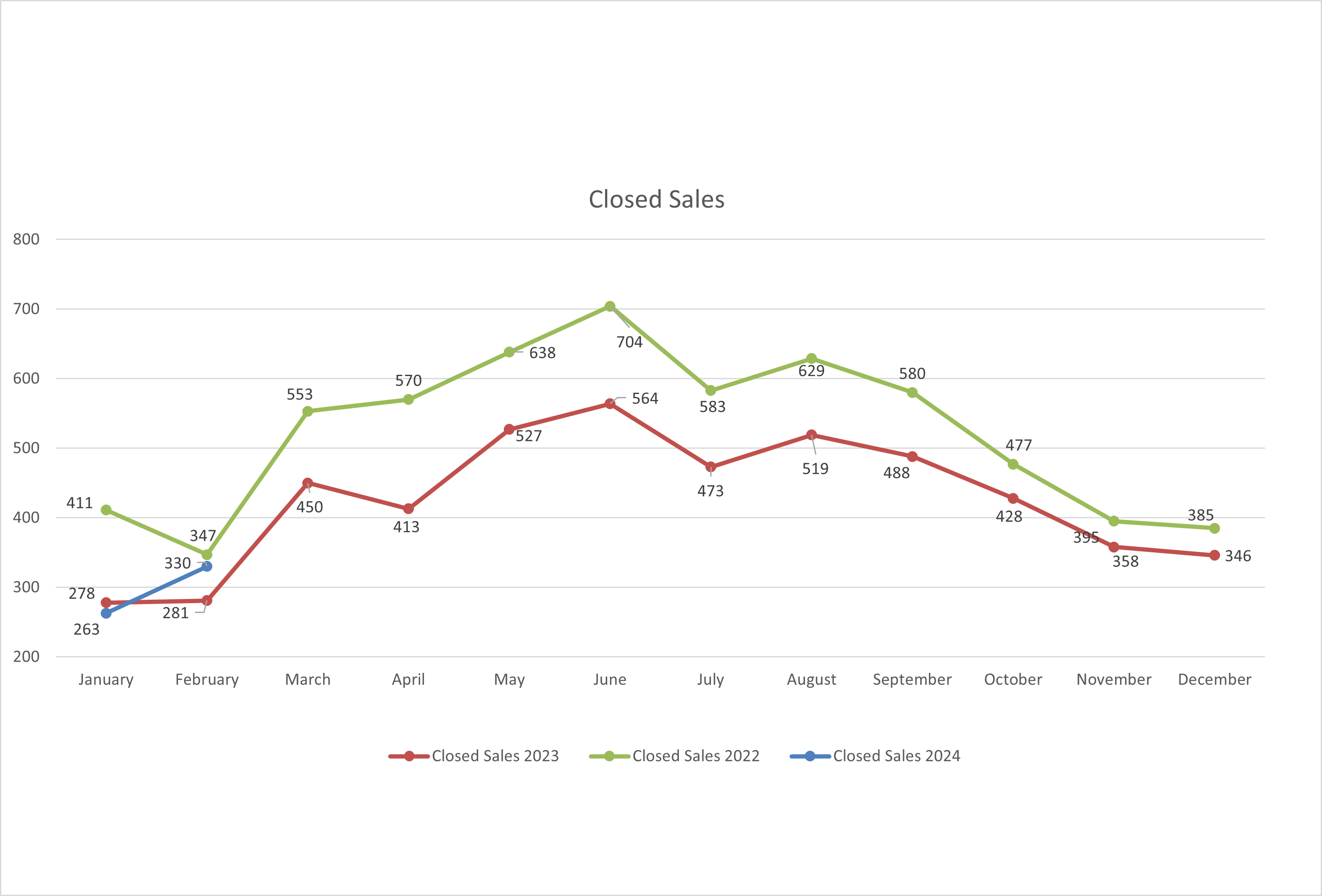

572 closed sales of single family homes on less than one acre, including condominiums were reported for March 2021.

This total is up 2.3% compared to March 2020 when 559 closed sales were reported.

Year to date closed sales through March total 1,478 compared to March last year when reported closed sales totaled 1,490 a decrease of less than 1%.

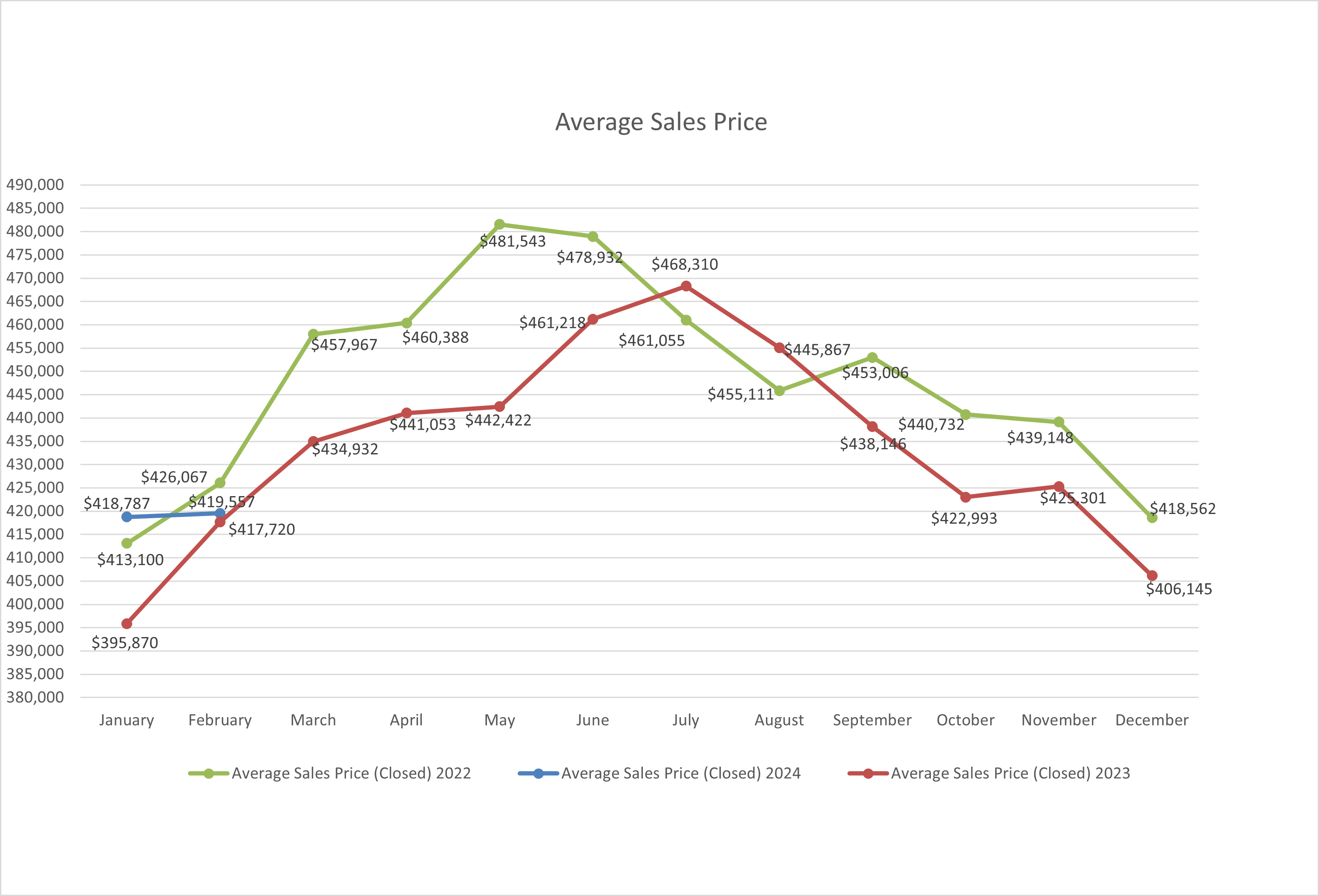

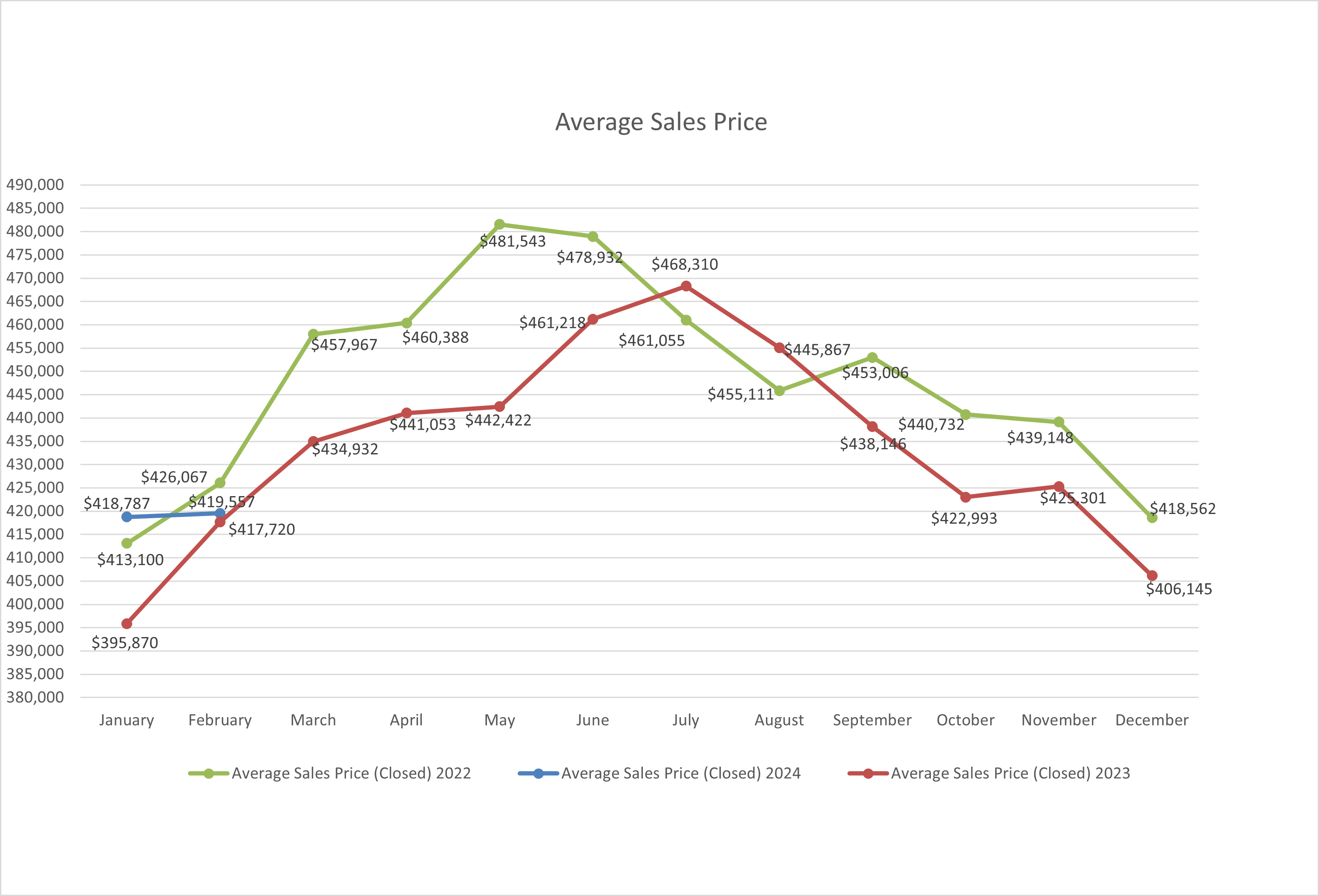

The average sales price was $371,874 an increase of 20.7% over March one year ago when the average closed sales price was $308,012.

The year to date average sales price through March is $358,488 an increase of 22.1% over the same period last year when the average closed sales price was $293,600.

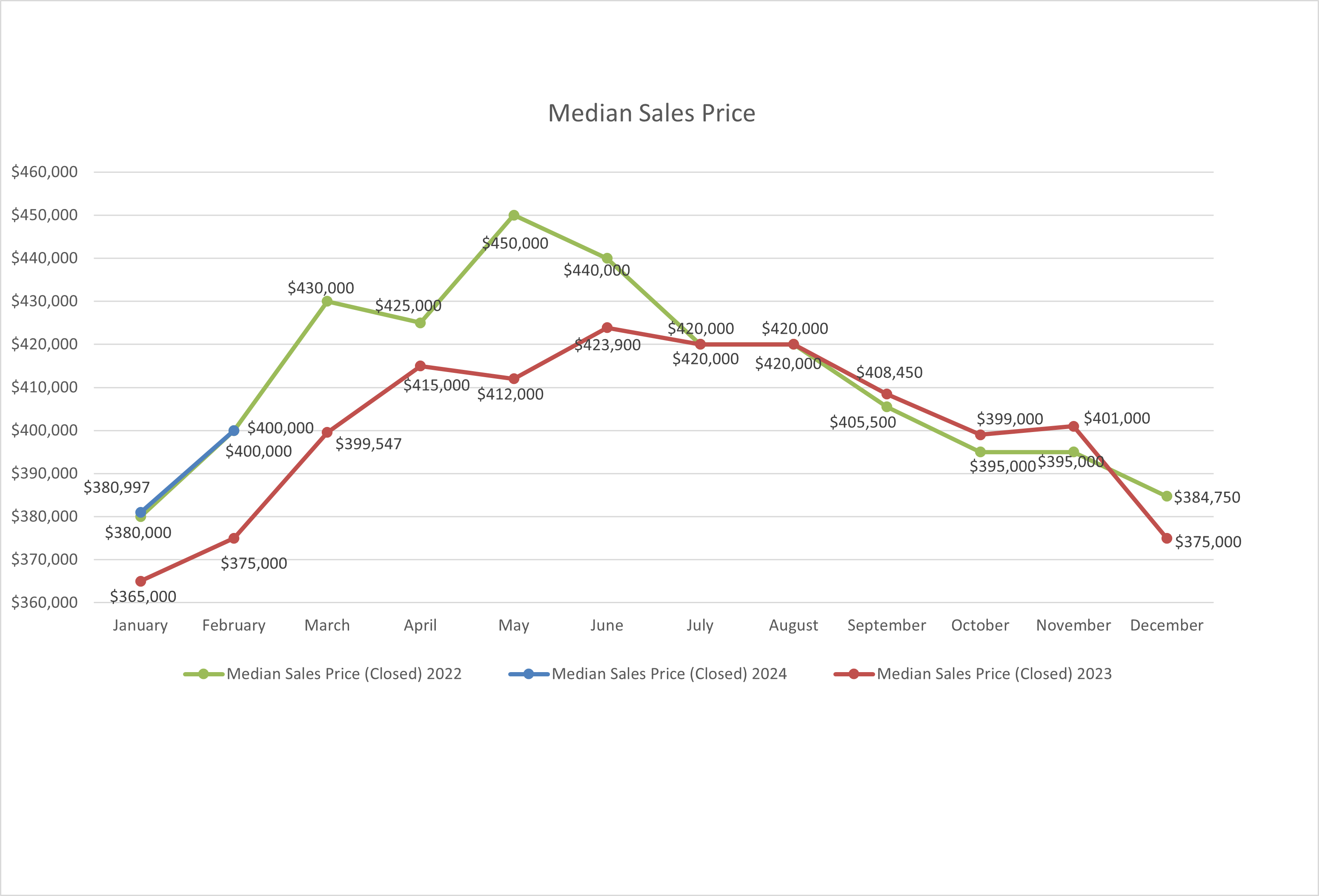

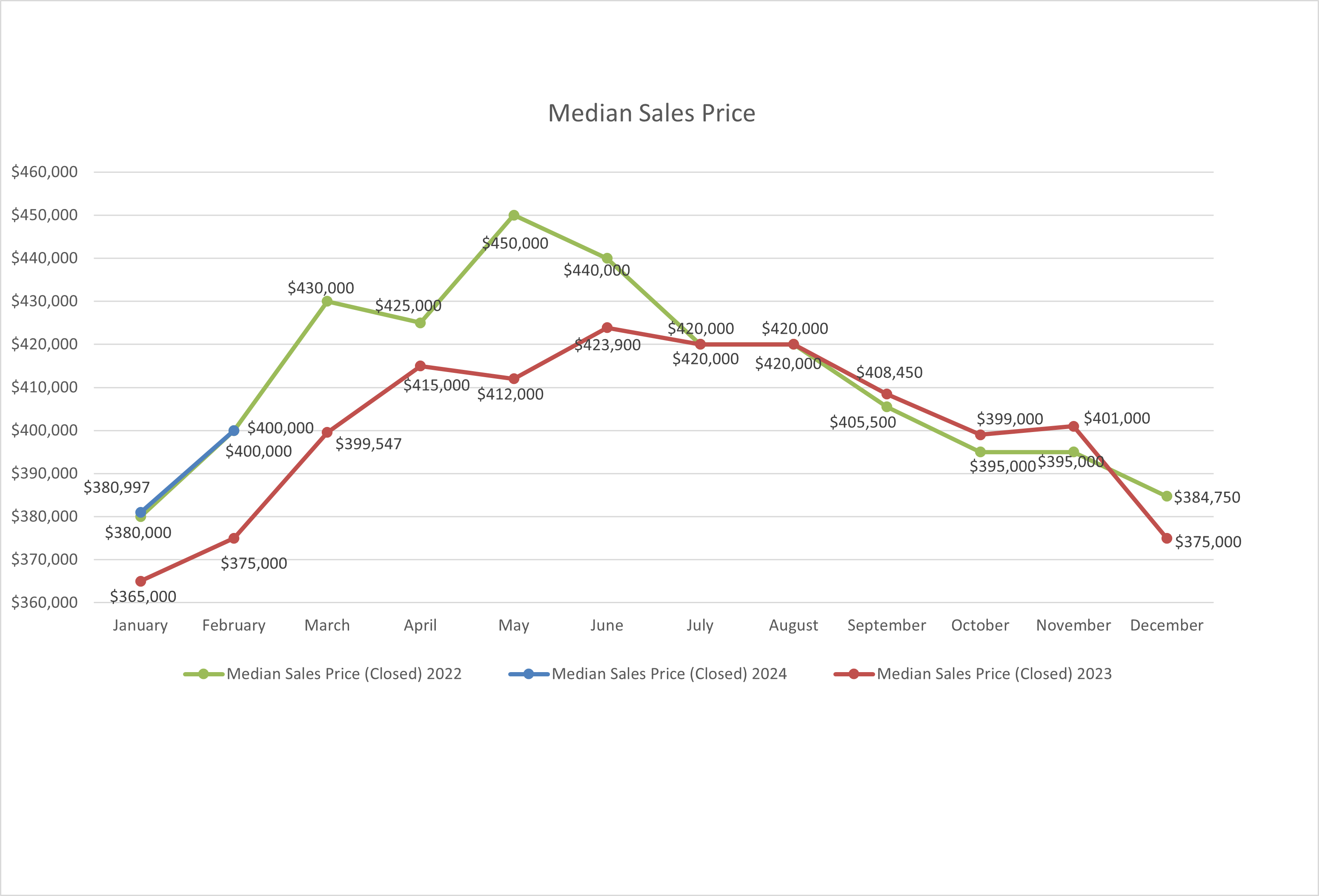

The median sales price for March was $341,750 an increase of 17.9% over March one year ago when the median closed sales price was $289,900.

The median year to date sales price is up 19.7% compared to last year, $329,275 vs. $275,000.

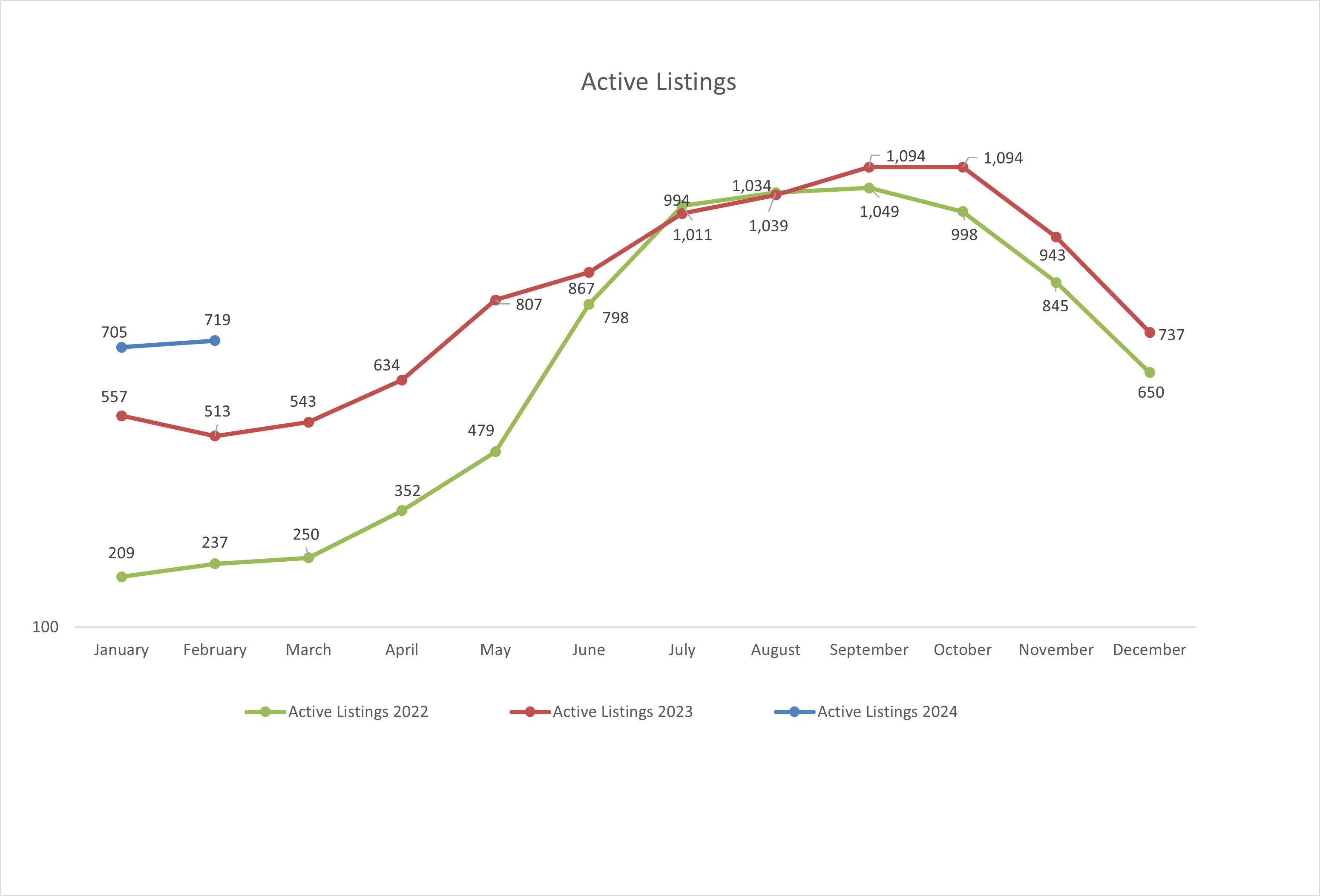

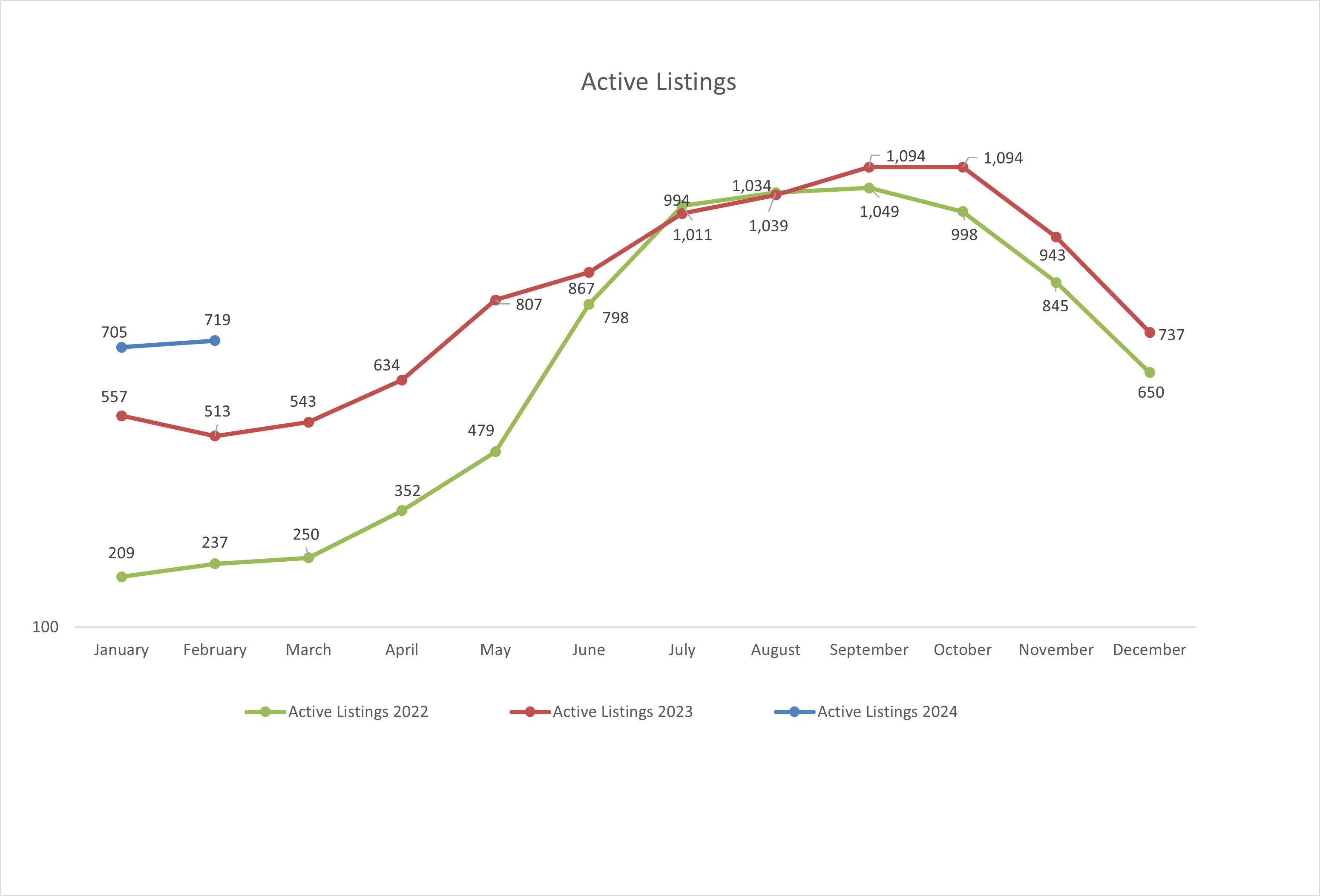

Spokane real estate market has seen an uptick from last month’s report when we reported our inventory at 133 properties.

As of this report there were 209 single family homes including condominiums on the market.

Last year at this time, however, there were 592 homes on the market.

New construction sales are up 2.7% compared to last year, 262 vs. 255

Real Estate Restrictions for COVID-19

Governor Inslee’s Latest COVID-19 Restrictions as it Pertains to Real Estate

November 16, 2020

Due to the recent spike in cases in Washington State, Governor Inslee has imposed new COVID-19 restrictions on all of us in an attempt to curb the surge. Below is a short list of the ways that the current restrictions impact the real estate business in Spokane County.

- There will be no real estate open houses.

- Real estate brokerage offices will have limited building occupancy and not open to the general public.

- All listings will be shown by appointment only.

- No more than 6 people, including the broker, may be in a listing at a time.

- Cloth face coverings will be worn at all times during showings.

- Social distancing of at least six feet will be practiced at all times.

Additional PPE such as booties and disposable gloves as well as specific instructions for buyers and buyers’ agents may be left at the main entrance of a listing. These items should be used and any instructions that address any other sellers’ concerns need to be fallowed.

A more general list; COVID-19 Guidance is posted in The News Room.